This monthly round-up brings you a selection of the latest news and updates on global trade.

Top international trade stories: Trump says US and China trade deal ‘done’; ASEAN’s ambitious economic strategy; US and UK finalise trade deal.

세계경제포럼, 2025년 6월 17일 게시

Anne-Katrin Pfister

Project Lead, Asia-Pacific Digital Trade, Monitoring and Evaluation, World Economic Forum

1.US and China trade deal ‘done’, says Trump

The US and China have restored a truce reached last month following two days of intensive trade talks in London, with President Donald Trump declaring the deal “done” pending final approval from both leaders.

Trump took to Truth Social to share details of the deal: “Full magnets, and any necessary rare earths, will be supplied, up front, by China. Likewise, we will provide to China what was agreed to, including Chinese students using our colleges and universities (which has always been good with me!).”

He said the US tariffs would be set at 55% on Chinese goods (up from 30%) while China’s tariffs remain at 10%.

Reuters reports the 55% comprises:

- a baseline 10% “reciprocal” tariff Trump has imposed on imports from nearly all US trading partners

- 20% on all Chinese imports

- pre-existing 25% levies on imports from China from Trump’s first term in the White House.

US Commerce Secretary Howard Lutnick told CNBC the 55% tariff would “definitely” not change.

The World Trade Organization’s Tariff & Trade Data tracker captured a timeline of the tariff war over the past three months, which peaked at a 143.45% tariff on Chinese goods in April.

Lin Jian, a foreign ministry spokesperson for China, told a news conference that “China has always kept its word and delivered results. Now that a consensus has been reached, both sides should abide by it.”

Tariffs imposed by China and the US have fluctuated since February.Image: Statista

Immediate economic impact

The trade tensions have severely disrupted bilateral commerce. US seaborne imports from China plummeted 28.5% year-over-year in May, marking the steepest decline since the pandemic as Trump’s brief 145% tariffs took effect.

Overall, US container imports fell 7.2% in May to 2.18 million 20-foot equivalent units, with West Coast ports particularly affected – Long Beach and Los Angeles saw China-origin imports decline by 31.6% and 29.9% respectively.

China’s export data reflected similar strain, with shipments to the US falling $15.2 billion to $28.8 billion in May compared to the previous year. The trade disruption contributed to China’s overall export growth slowing to 4.8% in May.

Global economic consequences

Trade tensions continue to hinder the global economy. On 10 June, the World Bank sharply reduced its 2025 global growth forecast to 2.3% citing ongoing trade turbulence as a primary factor. This represents the slowest projected growth since 2008, excluding recession periods.

The World Bank’s Global Economic Prospects report also found that progress by emerging market and developing economies (EMDEs) in closing per capita income gaps with advanced economies and reducing extreme poverty is anticipated to remain insufficient. The outlook largely hinges on the evolution of trade policy globally.

Meanwhile, the dollar dropped to a three-year low on 12 June, reported the Financial Times, as Trump told the press he would be issuing letters to trading partners outlining new tariff rates, as a 90-day pause on reciprocal tariffs comes to an end on 8 July.

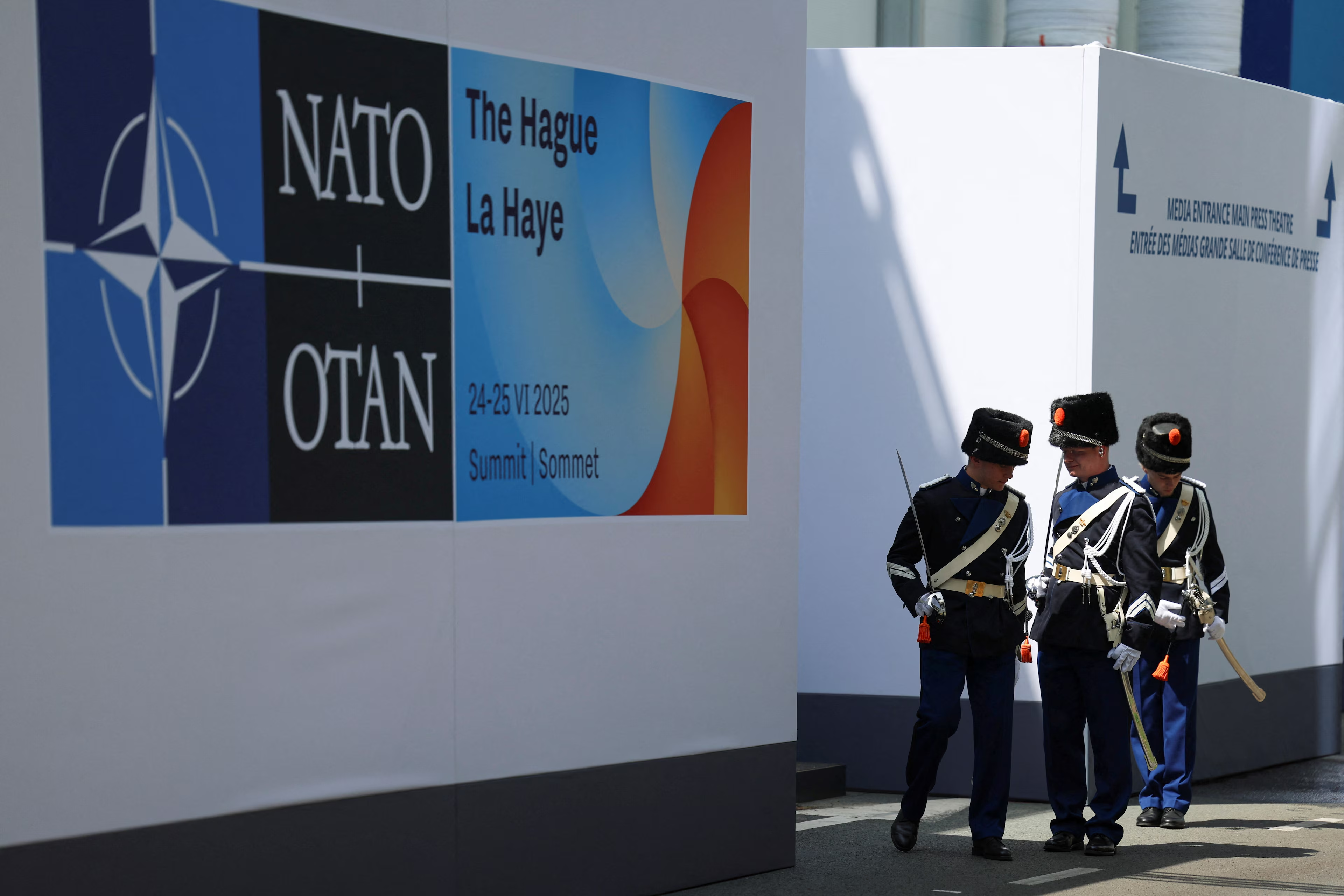

2. ASEAN unveils ambitious economic integration blueprint

The Association of Southeast Asian Nations (ASEAN) unveiled a comprehensive five-year strategic plan during its leaders’ summit in Malaysia, aiming to transform the 10-member bloc into the world’s fourth-largest economy by 2045.

The 41-page ASEAN Economic Community Strategic Plan (2026-2030) calls for harmonizing trade standards, deepening financial integration and enhancing regional connectivity.

The bloc also concluded negotiations on an upgraded ASEAN Trade in Goods Agreement (ATIGA), which will be formally signed at a meeting in October, Nikkei Asia reports.

The plan emphasizes increased intra-regional trade, freer movement of businesses and people, improved transparency and sustainable policies to attract foreign investment.

It notes that ASEAN countries must strengthen supply chains, pursue energy security and boost transport connectivity to achieve these ambitious goals.

3. News in brief: Trade stories from around the world

The US and the UK said on Monday that they have finalised the trade agreement struck last month, lowering tariffs on certain British goods like cars, aerospace equipment, and steel and aluminum.

Indonesia and Singapore signed landmark deals to trade low-carbon electricity, collaborate on carbon capture and storage and develop green industrial zones, aiming for $10 billion in investment and 3.4GW of power exports by 2035.

Global stocks slumped and oil prices soared after Israel launched a military strike on Iran, prompting investors to seek safety in assets like gold and the Swiss franc.

It comes as OPEC Secretary General Haitham Al Ghais said global oil demand will continue to grow robustly over the next 25 years with no peak in sight, projecting consumption to exceed 120 million barrels per day by 2050.

Eurozone industry and trade suffered sharp declines in April 2025, with industrial output dropping 2.4% and exports to the US plunging amid tariff turmoil, challenging expectations of economic resilience.

British goods exports to the US fell by a record £2 billion ($2.72 billion) in April – a 33% drop from March – after new Trump tariffs took effect, widening the UK’s trade deficit.

German exports fell 1.7% in April, driven by a 10.5% drop in shipments to the US due to new tariffs, offset slightly by a 0.9% rise in exports to the EU.

China has announced it will eliminate all tariffs on imports from 53 African countries with which it has diplomatic ties, aiming to boost trade and offer African exporters broader access to its market.

4. More on trade on Forum Stories

Enabling access to rare earth minerals, which are primarily produced and processed in China, has been a sticking point in the country’s trade talks with the US. Rare earths are just one example of something countries have opted to mostly rely on others to produce – until reassessing that reliance. The industry’s history in the US, once the world’s top producer, is a tale of decline and slow rebirth.

The ASEAN Digital Economy Framework Agreement (DEFA) is intended as a new strategic roadmap for the region to address the complexities and opportunities of the digital economy. The world’s first region-wide digital economy agreement, it would harmonize digital trade rules and unlock the region’s potential. With ASEAN’s digital economy set to double to $2 trillion by 2030, DEFA will be an engine for dynamic growth.

The African Continental Free Trade Area (AfCFTA) has the potential to uplift women and unlock billions in income across Africa. Women traders have limited voice in formal governance mechanisms. Investment in grassroots trade networks and digital inclusion could help women traders in Africa access the full benefits of the African single market.