So far, this year has been marked by significant global shifts, including increased geopolitical instability, the accelerating impact of AI and a changing labour market.

Economic factors like new US tariffs are redrawing trade maps, while the energy transition shows progress and gender gaps persist.

These seven charts from World Economic Forum reports help illustrate the inflection points this year.

세계경제포럼, 2025년 8월 5일 게시, 2025년 8월 7일 업데이트

Kate Whiting

Senior Writer, Forum Stories

When the dust settles on 2025 and dictionaries recap the words that have been used the most, it’s likely that ‘inflection point’ will be somewhere in that mix.

From the impacts of artificial intelligence to Ursula von der Leyen’s take on China-EU relations, headlines abound with the term.

Meanwhile at the World Economic Forum’s Annual Meeting in January, Forum President and CEO Børge Brende stated that “we are at an inflection point,” noting that the gathering was taking place during “one of the most uncertain geopolitical and geoeconomic moments in generations.”

Since then, multiple Forum reports have surveyed experts and provided a comprehensive lens into the driving forces shaping our world. Such forces range from economic and geopolitical fragmentation to AI’s accelerating disruption and the imperative for equity and sustainability.

Six months into the year, how has 2025 unfolded and what are the big themes? Here are seven charts that can help explain the year so far.

https://open.spotify.com/embed/episode/5K2t1dX5qXOgGmEgX0xvT8

1. Geopolitical fracture and global risks reach new highs

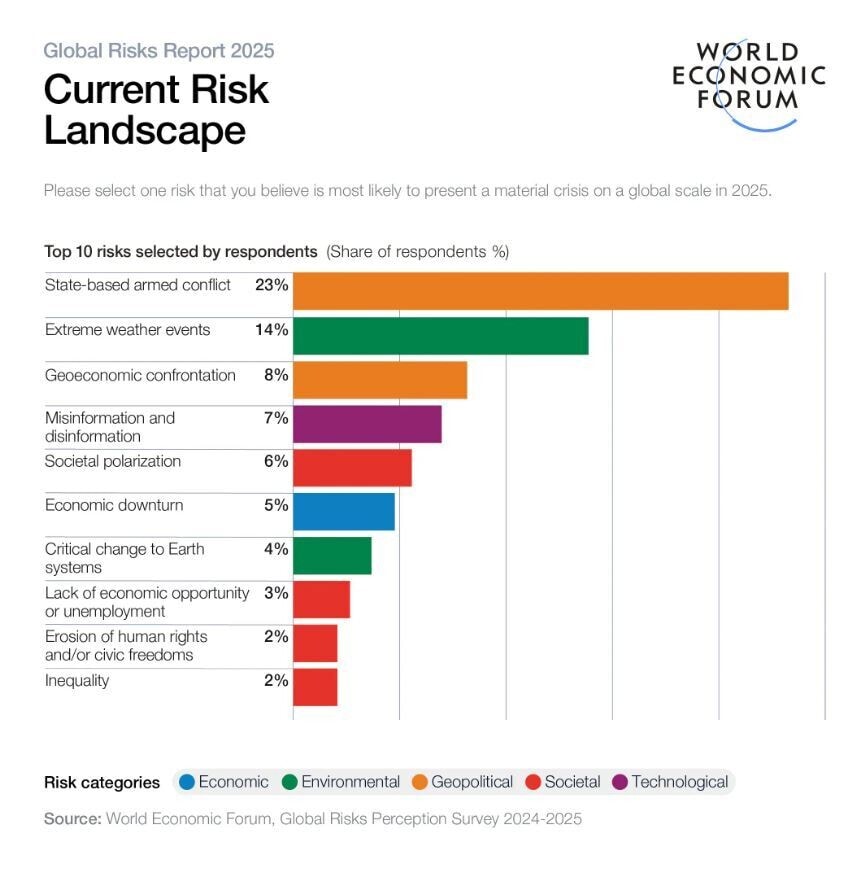

In January, the Global Risks Report 2025 signalled mounting pessimism for the world in the coming years, with 52% of chief risk officers anticipating an “unsettled” short-term future. Conflict, misinformation and severe weather events topped the list of immediate concerns.

Quick insight: State-based armed conflict is now the #1 risk for 2025. Proliferation of misinformation – amplified by generative AI – and societal polarization feed instability, making this one of the most divided periods since the Cold War.

The global picture: More than 110 armed conflicts are taking place around the world today, with some more widely known than others. The war in Ukraine has been going for three and a half years and has claimed the lives of more than 350,000 Ukrainian and Russian troops. US President Donald Trump has called for an end to the war by 8 August. The Israel-Gaza conflict, which began in October 2023, has led to famine being declared in Gaza and G7 leaders are planning to recognize a Palestinian state. Meanwhile, this year has already seen record-breaking severe weather events, including drought, wildfires and flash floods in the US – with NASA data showing these events are becoming more frequent, longer-lasting and more severe. The International Court of Justice ruled in July that countries are legally obligated to curb emissions and protect the climate.

Watch: Experts explain the biggest risks facing the world today.

2. The AI revolution accelerates

AI is moving from hype to wholesale transformation, as the Forum’s Industries in the Intelligent Age series shows. The impacts of AI are felt across all functions: operations, content, supply chains and sales. For example, AI-driven processes in consumer industries are expected to cut content production costs by 60% and boost conversion rates by up to 20%.

Quick insight: By 2038, responsible, people-centric AI could unlock $1.2 trillion for consumer industries.

The global picture: This has been the year of the DeepSeek phenomenon and the rise of AI agents. Chipmaker Nvidia and Microsoft both hit a stock market capitalization of over $4 trillion – the first companies to do so – with investors seeing Microsoft’s investments in data centres and OpenAI pay off. The electricity demand from data centres is expected to rise from 1% of global energy demand in 2022 to over 3% by 2030. But that’s balanced against a potential for AI to help companies reduce energy use by up to 60%, as the Forum’s white paper Artificial Intelligence’s Energy Paradox: Balancing Challenges and Opportunities shows.

Listen: Google’s Chief Economist spoke to Radio Davos about the impact of AI.

https://open.spotify.com/embed/episode/0jPBeAj7RYXSOgtVyb8Slj

3. The global labour market is in flux

AI joins several other disruptive forces identified in the Future of Jobs Report 2025: Climate change and the green economy now drive almost half of all employers’ workforce strategies. Demand for sustainability-linked and AI/tech roles is soaring, while routine clerical and admin roles continue to decline.

Reskilling and inclusion have become urgent priorities. Many employers cite skills gaps, prompting a shift towards continuous workforce learning. Meanwhile, the gender and age divides in job opportunities persist.

Quick insight: 86% of employers expect AI and data analytics to reshape their sectors, with GenAI driving both job creation (an estimated 170 million new roles by 2030) and displacement (92 million roles to be automated).

The global picture: Tech companies have eliminated thousands of jobs so far in 2025, with AI cited as a driving factor in many layoffs, but the reality is more nuanced than simple displacement. Major firms have announced significant workforce reductions, partly to fund AI investments rather than because AI has replaced workers. While AI threatens to eliminate many entry-level positions that historically served as career launching pads, it’s simultaneously creating new categories of work including AI engineers, prompt specialists, and data scientists. The return-to-office mandate trend adds another layer of complexity, with only 42% of workers willing to comply with five-day office requirements, down from 54% in early 2022. This resistance is particularly pronounced among women and parents, who increasingly view flexible working as non-negotiable.

Listen: Adecco Group’s President, Christophe Catoir, talked to Meet the Leader about the need to protect employability as well as jobs.

https://open.spotify.com/embed/episode/4W4gOdFfzQQLLJMGcLaNxD

4. Trump’s tariffs are redrawing the global trade map

In May, the Forum’s Chief Economist Outlook found the global economic outlook had worsened since the start of the year, as rising economic nationalism and tariff volatility fuel uncertainty and risk stalling long-term decision-making.

Trade fragmentation is accelerating, with global growth projected to slow to 2.3% in 2025 due to rising barriers and policy uncertainty. In January, the Forum, along with Oliver Wyman, estimated the cost of global financial system fragmentation, or the increasing disintegration of the interconnected global financial landscape into distinct blocs, to be between $0.6tn and $5.7tn.

Quick insight: Trade policy is the highest area of global uncertainty for Chief Economists polled in May – at 97%.

The global picture: Since returning to office in January, US President Donald Trump has implemented the most sweeping tariff regime since the 1930s, fundamentally reshaping global trade patterns. Following his “Liberation Day” declaration on 2 April, he imposed a baseline 10% tariff on most imports, complemented by targeted duties including 50% on copper, 25% on cars, and escalating rates on specific countries. By July 2025, the average effective US tariff rate had reached 18.2% – the highest level since 1934. The global response has been swift and strategic. Countries are actively diversifying trade networks beyond the US, with China redirecting exports towards Europe (6% growth) and Mexico/Canada (25% growth). The European Central Bank notes that Chinese trade diversion from the US could actually lower eurozone inflation. Meanwhile, nations are rushing to negotiate bilateral deals to avoid rates of up to 50% which were due to be imposed on 7 August.

Listen: A panel of expertsjoined the Forum’s Annual Meeting of the New Champions in June to discuss how leaders can look beyond the current volatility.

https://open.spotify.com/embed/episode/5ky2fTwhoQKmOqVD5m05be

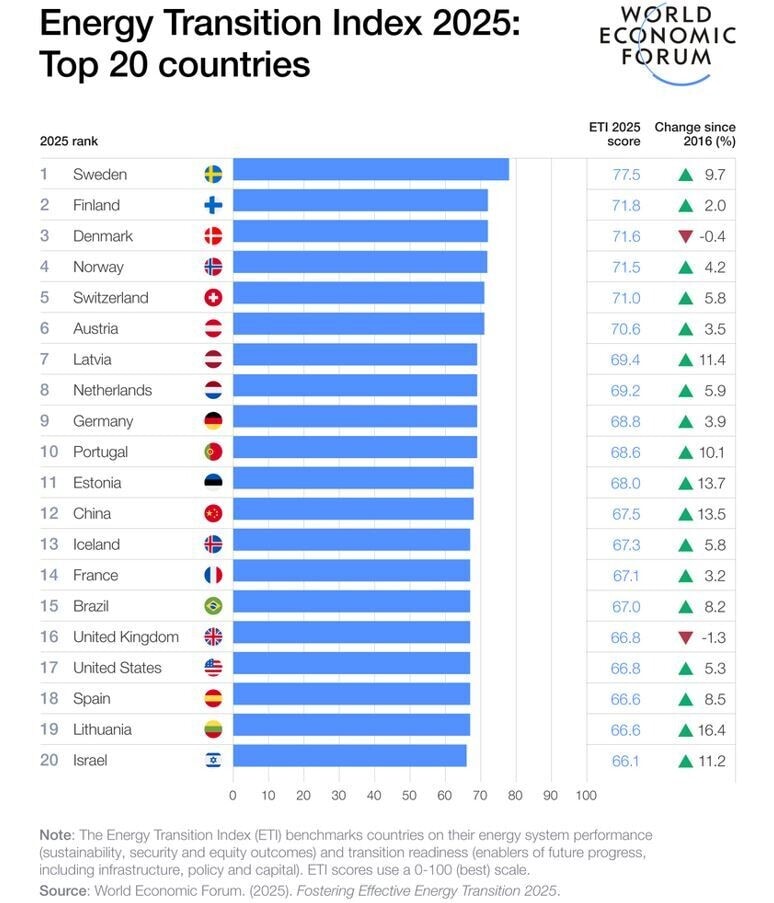

5. The energy transition gains momentum but risks stall progress

In June, the Energy Transition Index (ETI) recorded the fastest improvements in a decade – but warned most countries lack the foundations to sustain progress. Clean energy investment hit $2 trillion, but the majority of this went to advanced economies and China, leaving other regions behind.

Energy access, affordability and emissions are improving, yet readiness for future shocks lags. Extreme weather and infrastructure stresses (notably from the rise of AI-driven energy demand) pose real threats to the net-zero pathway.

Quick insight: After several years of slow momentum, overall ETI scores in 2025 improved 1.1%, more than double the average rate of the past three years, reflecting the accelerating recovery in energy transition progress.

Overall ETI scores are up.Image: World Economic Forum

The global picture: The global energy transition has reached a critical tipping point in 2025, with renewable sources now 41% cheaper than fossil fuels for solar and 53% cheaper for wind power. This cost advantage has driven record-breaking deployment, with renewables accounting for 92.5% of all new electricity capacity additions globally in 2024 and meeting nearly three-quarters of electricity generation growth. China has surged ahead, producing almost as much solar power in the first three months of 2025 as in all of 2020. The country’s clean energy sector now represents 10% of its economy. But surging energy demand threatens to outpace clean energy deployment. Global electricity consumption rose by 4.3% in 2024, driven by extreme weather, data centres, and electrification efforts, highlighting the complex balance between energy security, economic development and climate goals.

Watch: Experts explain how the global energy transition is going.

6. Gender gaps persist – especially in tech, AI and health

In 2025, gender parity remains elusive worldwide. The Global Gender Gap Report finds modest progress with the global gender gap now 68.8% closed – meaning full equality is 123 years away at current rates. Only Iceland exceeds 90% gender parity. The divide is especially stark in fast-growing sectors like tech, AI and health, where women are markedly underrepresented in senior roles and emerging fields.

Despite strong gains in education and health parity overall, economic participation lags, with women holding far fewer leadership and STEM positions. Urgent action is needed to overcome persistent barriers and ensure inclusive growth in the most influential industries of the future.

Quick insight: Data from LinkedIn members in the US shows more women than men will be in jobs disrupted by GenAI (57% vs. 43%), whereas fewer women than men will see their work augmented (46% vs. 54%) by GenAI.

The global picture: In January, the Forum published a blueprint to closing the health gender gap, focused on nine underdiagnosed conditions in women, which are underfunded and under-researched. It found closing this gap adds almost 27 million disability-adjusted life years annually (equivalent to 2.5 additional healthy days per woman) and $400 billion to global GDP by 2040, thereby improving the quality of life for women worldwide. In May, the Global Alliance for Women’s Health, in collaboration with Kearney and the Gates Foundation, launched a white paper advocating for policy changes to advance innovation and inclusivity in women’s health, including more representative clinical research. Meanwhile, the Forum’s work on Gender Parity in the Intelligent Age highlights growing disparities in tech. Women make up less of the global AI workforce and face a higher risk of job loss from automation. Yet they lead in the adoption of soft skills crucial for the AI era, and the share of women with AI skills is steadily rising, signalling potential for inclusive innovation if supported by targeted policy and educational initiatives.

Watch: Forum Managing Director,Saadia Zahidi, joins Sue Duke, Head of Global Public Policy at LinkedIn, and Norman Loayza, Director of the Global Indicators Group at the World Bank, to discussthe state of gender parity in 2025 and what needs to happen to close the gap.

7. Society needs to adapt to support the longevity economy

The world is heading towards a demographic tipping point, as the Forum’s longevity research shows: by 2080 the global population aged 65+ will outnumber those under 18.

Key actions needed include modernizing retirement and pension systems, investing in life-long skills, expanding caregiving economies and enabling “longevity literacy”. Countries and corporations are challenged to turn longer lives into better, more productive and financially secure lives – not merely a greater burden on welfare.

Quick insight: By 2060, Asia will have 60% of the world’s population aged 65 and older.

The global picture: The global population in 2025 stands at just over 8.2 billion, but growth is slowing sharply as birth rates decline worldwide. Many countries – most notably China, Japan and across Europe – now face shrinking or stagnant populations, coupled with rapidly ageing societies: in some, a quarter of people are over 65. Fertility rates in dozens of nations have fallen below replacement level, putting pressure on healthcare systems, pensions and labour markets. While countries such as India and Nigeria continue to grow, much of the world is entering an era defined less by population boom than by the social and economic challenges of longevity.

The path forward

Navigating these interconnected inflection points over the coming months will require real momentum from the global community, particularly around six key issue areas:

- Multilateral solutions and renewed global collaboration, especially on conflict and misinformation.

- Rapid scaling of upskilling and reskilling initiatives, focusing on those most at risk of job transformation.

- Redesign of financial and retirement systems for a longevity society.

- Investment in sustainable infrastructure, and targeted efforts to close gaps in global energy transition progress.

- Gender parity as a driver of innovation and resilience. Better AI literacy and accessibility for women and youth are critical.