This regular roundup brings you essential news and updates on the global economy from the World Economic Forum’s Head of Economic Growth and Transformation.

Top stories: US revives sweeping tariff plans; trade and investment flows continue to realign around geopolitical fault lines; developing economies face rising constraints as global financing divides deepen.

세계경제포럼, 2025년 7월 15일 게시

Aengus Collins

Head, Economic Growth, Revival and Transformation, World Economic Forum

US policy remains a major source of uncertainty for the global economy.

But as other countries respond, signs are emerging of a deeper transformation – and of a reconfiguration of global-trade and financial flows.

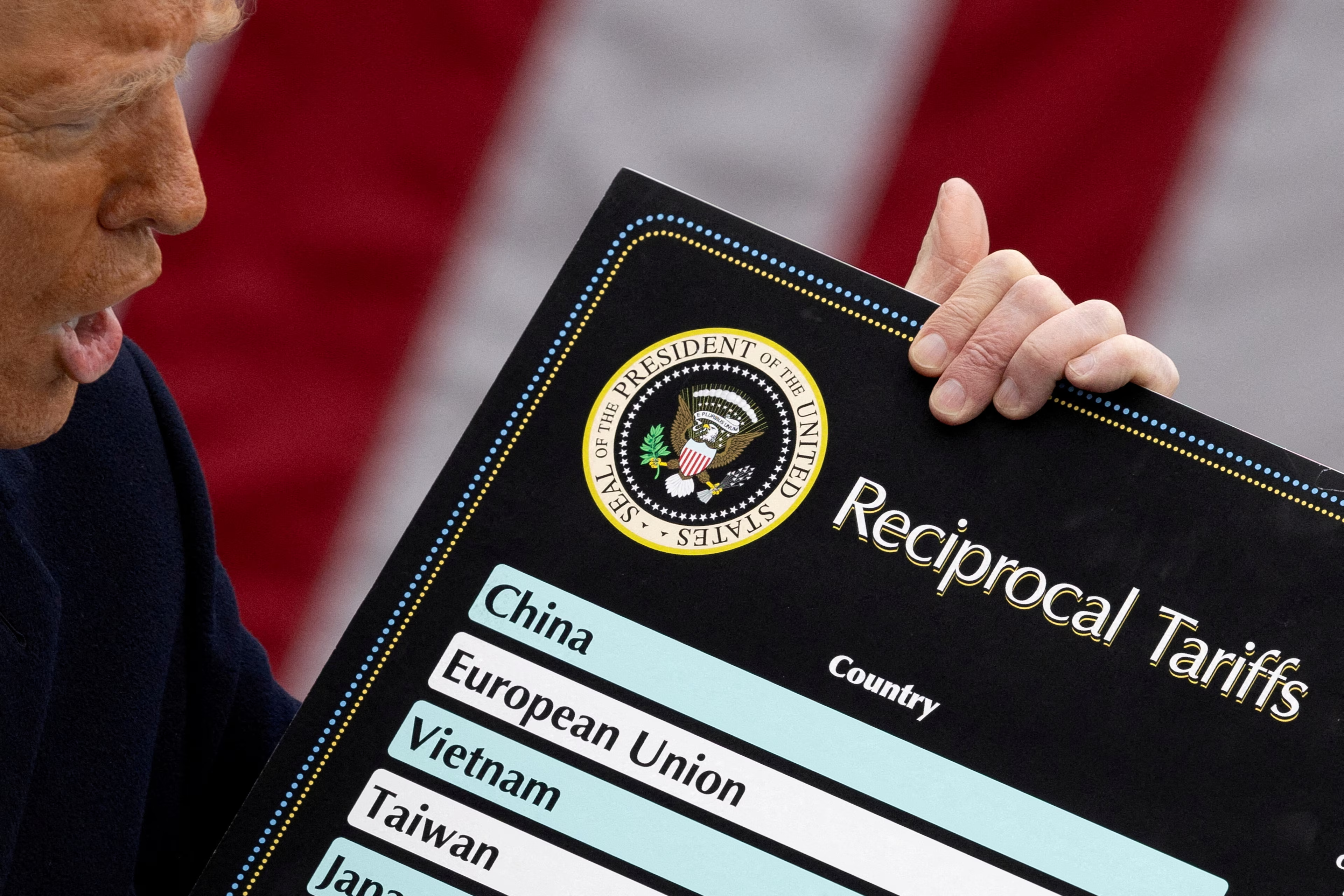

July 9 marked the end of a 90-day pause on sweeping US tariff proposals that had triggered market turmoil when first announced in April. Although the pause was extended to August 1, hopes of de-escalation faded after the US signaled new tariffs for more than 20 countries that were broadly in line with those initial April proposals.

These include a renewed threat of a 35% tariff on imports from Canada, a 30% tariff on imports from the EU and Mexico, a 25% tariff on imports from Japan and South Korea, and a potential 50% tariff on all imports from Brazil. The US administration also flagged new levies on imported copper, and hinted at a tariff of 200% on pharmaceutical imports if US producers fail to move production back to the US within an unspecified transition period.

Notably, the announcements did not trigger a repeat of April’s market turmoil.

The S&P 500 index slipped just 0.2% last week, while equities in Japan and South Korea actually rose slightly, reflecting market skepticism about whether the full slate of threatened trade measures will be enacted. However, with investors now facing a broadening tariff front, that sense of relative calm may be tested as the implications of further escalation are weighed.

What happens next remains uncertain. While trading partners may seek bilateral deals with the US to avoid the harshest measures, some analysts have voiced concern that muted market reactions may encourage US policymakers to escalate further – risking sharper disruptions ahead. What seems clear is that policy uncertainty is now interacting with a broader global economic realignment in ways that are still unfolding.

Geopolitical fault lines reshape trade and investment flows

As markets have remained relatively steady, many governments have begun to adjust course in the face of heightened policy uncertainty and the prospect of significant disruption. These efforts are not only aimed at mitigating the impact of threatened tariffs, but also at navigating an increasingly fragmented global economy.

Canada, for example, has accelerated trade negotiations with ASEAN in a bid to reduce its reliance on the US market. Across Asia, countries such as South Korea, Indonesia, and Viet Nam are actively pursuing new trade agreements and strengthening economic ties with partners like the EU and Australia; Indonesia is reportedly close to finalizing a deal that would eliminate most tariffs with the EU.

Such moves reflect a broader trend: trade flows are being reshaped by strategic considerations that go deeper than tariffs. Recent trade data underscore the structural changes under way.

Global trade rebounded by around $300 billion in the first half of 2025, driven by strong US imports and EU exports. But while the aggregate picture is encouraging, most of the gains were in developed economies while developing-country exports and south-south flows have been relatively weak. The data also point to a decline in trade concentration and nearshoring, indicating a gradual shift away from hyper-centralized production networks and towards more politically aligned and diversified trade relationships. Diverging industrial policies and geopolitical risks may only reinforce this dynamic.

Currency markets are also beginning to reflect the shifting global landscape. Despite higher US interest rates, the dollar has weakened, while the euro has gained ground, supported by renewed efforts to deepen fiscal integration within the EU and growing investor interest in more stable alternatives. Monetary signals are increasingly being filtered through a lens of strategic alignment and resilience, and some European officials have described the current environment as a ‘global euro moment’ – that is, an opportunity to strengthen the currency’s international role as trust in the dollar falters.

Imbalances are also becoming more apparent in terms of access to capital. While advanced economies continue to expand deficits and deploy large-scale fiscal interventions, many lower-income countries face tightening conditions and rising debt-servicing costs. In response, momentum is building around the need for more coordinated multilateral approaches; the Sevilla Commitment was recently launched at the Financing for Development summit held in that city, setting out new tools for debt relief and greater participation of civil society and local actors in financial governance.

News in brief

- Writing from the Financing for Development summit in Seville, economists argue that resolving the global development crisis requires access to long-term, low-cost finance. They call for overhauling sovereign debt restructuring, reducing borrowing costs for poorer countries, and shifting from short-term speculative flows to productive investment.

- A new World Bank report warns that nearly 60% of the world’s extreme poor will live in fragile and conflict-affected economies by 2030. These places face overlapping crises – though with sustained support and targeted reforms, they hold untapped potential for more inclusive growth.

- The US Congress passed the One Big Beautiful Bill Act, enacting sweeping tax cuts and spending increases projected to add up to $5.5 trillion to the country’s public debt over the next decade. The Economist explains in 10 charts how the legislation could widen inequality, weaken long-term growth, and sharply raise the number of uninsured Americans.

- Last month’s Israel-Iran escalation, including strikes on oil and gas fields, has worsened an already fragile Iranian economy marked by 35% inflation, 18% poverty, and shrinking output. With revenues down and foreign trade heavily restricted, Iran’s ability to recover is constrained.

- The EU’s new Defence Readiness Omnibus aims to fast-track permitting and unlock funding as Europe boosts defence spending. While the rearmament push may add up to 500,000 manufacturing jobs, experts caution it won’t reverse deindustrialization without long-term orders and targeted reskilling.