This regular roundup brings you essential news and updates on the global economy from the World Economic Forum’s Head of Economic Growth and Transformation.

Top stories: China and the US agree to sharply scale back tariffs, the most prominent of a handful of tentatively positive developments amid an otherwise gloomy economic outlook.

세계경제포럼, 2025년 5월 14일 게시

Aengus Collins

Head, Economic Growth, Revival and Transformation, World Economic Forum

The global economy remains fraught with uncertainty following the dramatic trade policy moves made by the US in early April. However, there has since been a palpable easing of tensions.

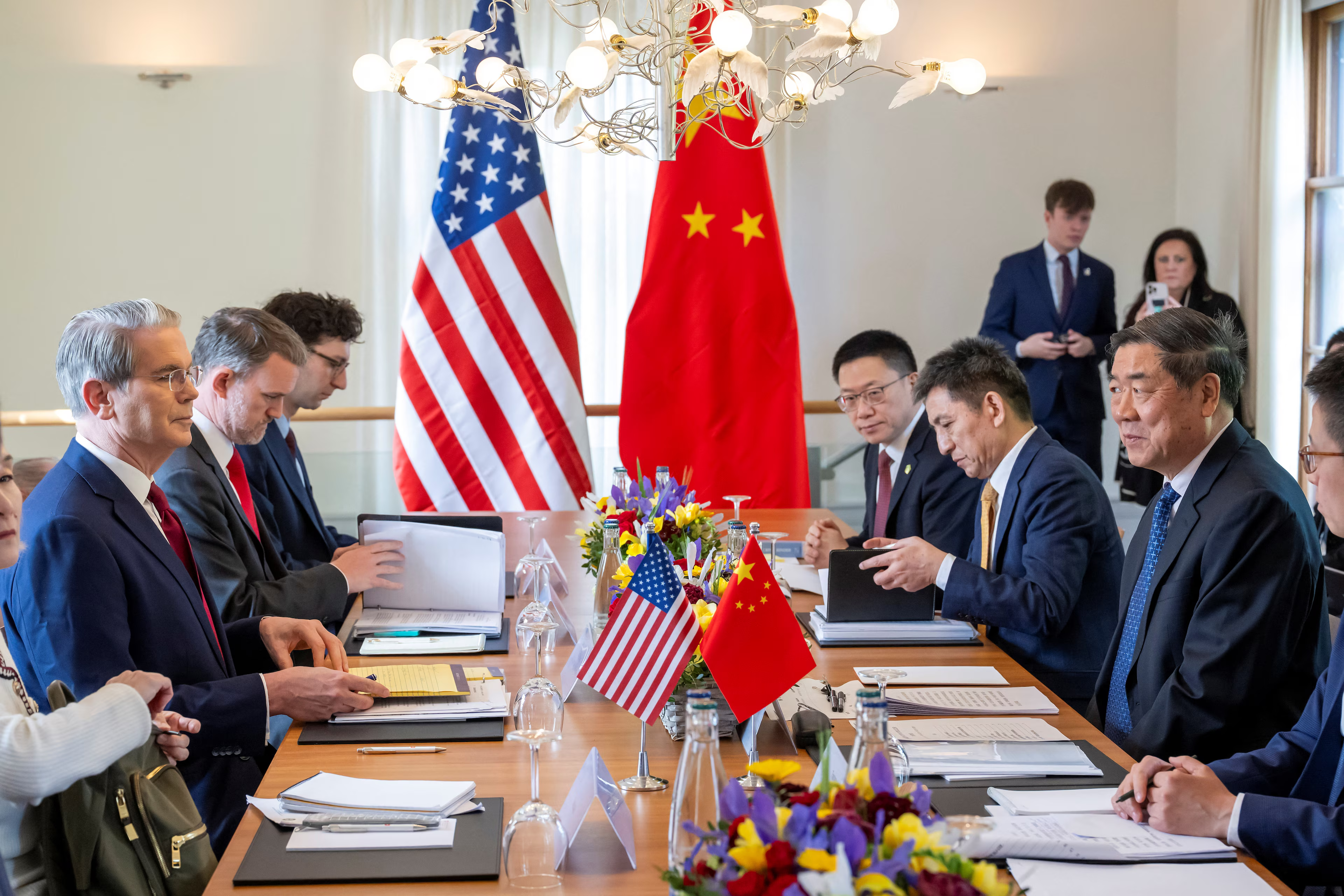

A particularly reassuring move back in the direction of the status quo ante was made on 12 May, when the US and China announced they had reached an agreement to reduce tariffs from previously eye-watering levels by 115 percentage points, for at least 90 days. Under the deal, a tariff of 30% will now apply on Chinese exports to the US, with a 10% tariff on goods going in the other direction.

The US-China agreement followed an earlier pausing of many of the tariffs that the US had announced for other countries. Markets breathed a sigh of relief in response to each hiatus, indicating a growing confidence that the rupture with the previous trading order might not be as extensive as had been feared.

Nevertheless, much remains unclear – at least until pauses elapse, and decisions are needed about whether to extend them.

Have you read?

- How impacted is your country by the Trump tariffs?

- What could work in a rewired global economy look like?

- WTO sounds alarm on trade risks as 2025 outlook weakens, and other international trade stories to know this month

If the current, calmer hiatus were to become the new status quo it would be counted as a major boost for the global economy. However, relief would inevitably be tempered by three facts: economic uncertainty remains extraordinarily high; policy and political trajectories have become much less stable; and powerful actors continue to push for major changes to structural underpinnings of the global economy that they deem unfair. There is still a bumpy road ahead.

Uncertainty as the only real certainty

The easing of US-China trade tensions is likely to lead to a softening of bearish forecasts for the global economy, as prospects recede for worst-case scenarios. Since early April, economists have struggled to produce projections amid unprecedented uncertainty, though most have been pointing in a decidedly gloomy direction.

One of the most closely watched forecasts is produced by the IMF, in its World Economic Outlook. The latest edition, published on 22 April, projected that global growth will slow to 2.8% this year, a significant downward revision from the previous 3.3% estimate. Other major institutions echoed this downbeat view; UNCTAD projected a global slowdown to 2.3%, while the WTO said that global trade volumes were on course to contract this year.

Unsurprisingly, the sharpest country-level downward revisions from the IMF were for those most closely caught up in the trade-related turmoil. The US growth forecast for 2025 was cut from 2.7% to 1.8%, while China’s was revised down from 4.6% to 4%. Canada’s growth outlook was revised down by half a percentage point, to 1.4%, while Mexico saw a particularly steep revision – down 1.7 points to a projected contraction of 0.3%.

All of these countries are likely to enjoy some respite as a result of the pausing of many of the threatened tariffs. However, while financial markets may have bounced back, repairing other economic damage may be a slower process. The US recorded an annualized GDP decline of 0.3% in the first three months of this year, and both consumer-sentiment and business expectations have slumped. A recent McKinsey survey found that more than two-thirds of executives anticipated a recession scenario.

News in brief: other global economic stories

- In response to a typical refrain about the US economy’s contraction in the first quarter, The Economist challenges a common misconception about GDP: that rising imports are a drag on growth.

- The latest UN Human Development Report focuses on AI and flags the impact of increasingly unequal access to digital infrastructure, opportunity, and agency.

- Under the rubric of South Africa’s G20 Presidency, the economist Mariana Mazzucato has called for paying more attention to the question: what kind of global economy do we need?

- US consumer sentiment dropped sharply in April, with the University of Michigan’s index falling to its lowest level since 1981 amid surging inflation expectations.

- Global public debt is on the rise. According to the IMF’s Fiscal Monitor, it’s set to climb by another 2.8% of global GDP this year and is on track to approach 100% of GDP by the end of the decade, surpassing the pandemic peak.