Donald Trump’s return to the White House has sparked intense discussions at Davos 2025 about global trade, technology and geopolitical dynamics.

Leaders are discussing ‘cautious optimism’ on tariffs, European unity on climate goals and how technological innovation could help offset potential disruptions.

Stay tuned for updates from the World Economic Forum’s Annual Meeting 2025, where Donald Trump will deliver a special virtual address on Thursday.

본 내용은 2025년 2월20일~24일간 스위스 다보스에서 개최된 세계경제포럼 연례총회(일명 "다보스 포럼") 중 열린 회의들과 관련하여 세계경제포럼이 정리하여 세계경제포럼 홈페이지에 게재한 내용을 옮긴 것입니다.Pooja Chhabria

Digital Editor, Public Engagement, World Economic Forum

As the global economy navigates a weak outlook, the return of Donald Trump to the White House sparked intense discussions at Davos 2025.

Across sessions, world leaders and industry giants have shared insights on how Trump’s return to power could influence trade, technology and the geopolitical landscape.

Stay tuned for updates from the World Economic Forum’s Annual Meeting 2025, where Donald Trump will deliver a special virtual address on Thursday.

On economic growth

The global economy faces significant challenges in 2025, according to the latest Chief Economists Outlook. Former US Treasury Secretary Lawrence H. Summers sees potential in technologies like artificial intelligence as growth drivers.

“There hasn’t been a moment when the technological possibilities ahead of the world have been as bright as they are today… That does not mean it’s all automatically going to be okay,” he cautioned at Davos.

For success, Summers emphasized three key priorities: controlling government debt, ensuring inclusive prosperity, and fostering international alliances. Beyond that, he said Trump’s past experience with efficiency could provide lessons.

“The first way Donald Trump came to prominence as a public figure was when the skating rink in Central Park couldn’t be fixed by the public sector, and he fixed it quickly in a way the public sector couldn’t.

“That is a small metaphor for a huge thing that needs to be corrected in our country and everywhere else. If we can get a government that is more about fighting fires, keeping the streets safe, collecting taxes efficiently, and letting businesses function, there is huge potential ahead.”

David M. Rubenstein, Co-Founder and Co-Chairman at global investment firm Carlyle, believes “getting the tax cut and other regulatory changes that President Trump wants implemented and into law relatively quickly” can spur economic growth, leading to a “fairly bullish” outlook for the US economy.

Chief economists expect US policy to have a significant impact on the global economy in the years ahead. Find out more in the Chief Economists Outlook: January 2025.

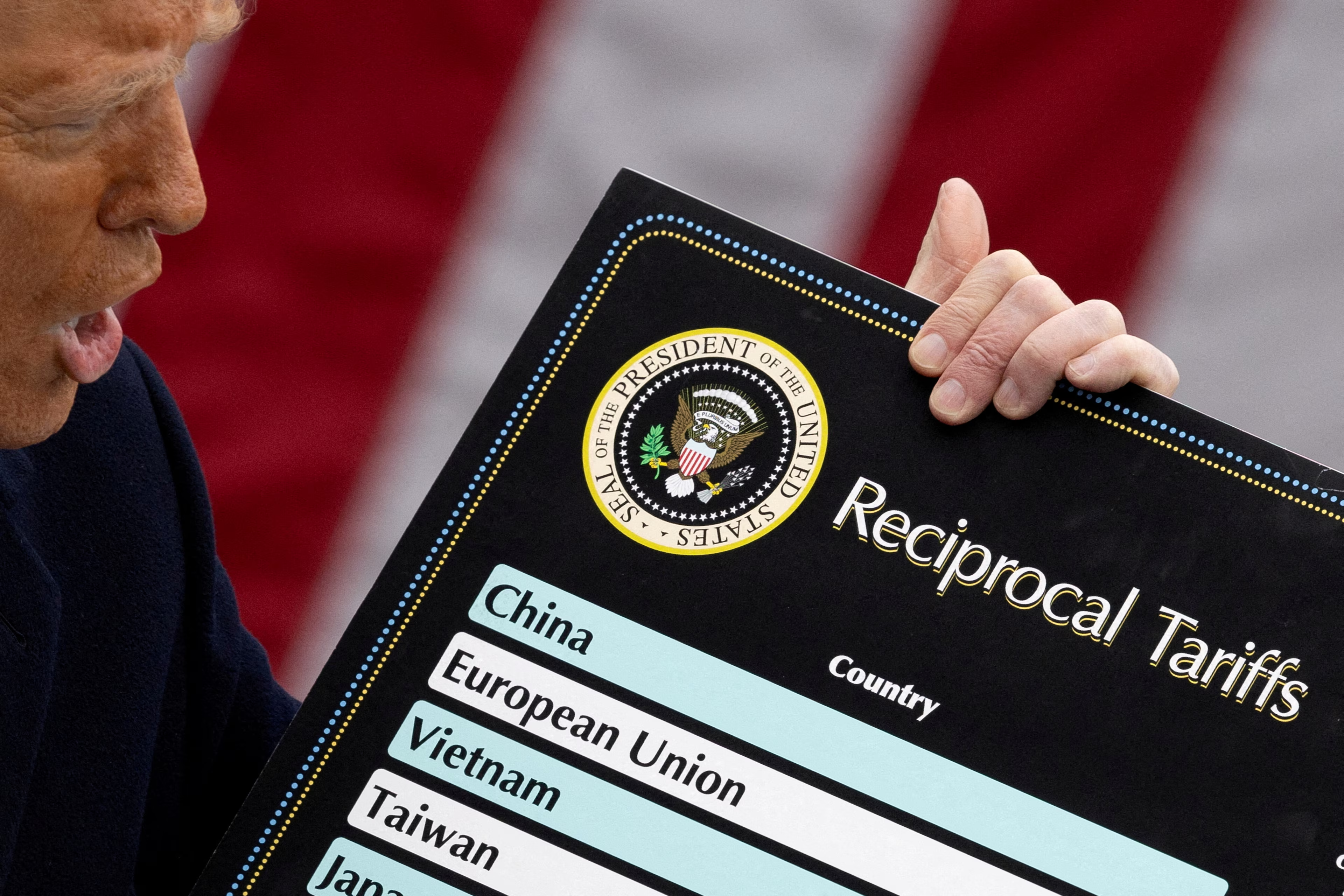

On tariffs and protectionism

The world has entered ‘a new era of harsh geostrategic competition’, European Commission President Ursula von der Leyen warns in her Davos speech.

“From AI to clean tech, from quantum to space, from the Arctic to the South-China Sea – the race is on.

“As this competition intensifies, we will likely continue to see frequent use of economic tools – such as sanctions, export controls and tariffs – that are intended to safeguard economic and national security.”

Trump’s promised tariffs and the potential impact on global trade has dominated discussions following his inauguration. Ngozi Okonjo-Iweala, Director-General at the World Trade Organization (WTO), advises “cautious optimism” as the policies are enacted and implemented. “Let’s keep calm and see what will actually happen,” she said in a panel discussion.

“President Trump said that he has reached out to China. So even as he announces these policies, he’s also trying to see if there can be a dialogue again. There might be something promising in all of that.”

But history, she warns, has shown us that a tariff war doesn’t benefit anyone.

Others, like the panelists discussing the US Economy in 2025, largely seemed to agree the tariffs might be negotiable. Bank of America’s Chair and CEO Brian Moynihan recalled President Trump’s first term where ‘tariffs had been negotiated on a bilateral basis to get China to buy more of certain categories of goods. Or, as the Wall Street Journal’s Editor Gerard Baker summed it up, the worst-case scenario might not necessarily end up doing that much damage because there will be offsetting effects.

Kenneth Rogoff, the Maurits C. Boas Chair of International Economics at Harvard University, also recounted Trump’s first term in office to explain how the US Federal Reserve will likely respond.

“When Trump raised tariffs on a much narrower scale in 2018, the Fed had just started raising interest rates…and they were worried about a recession. So to think that imposing these tariffs is going to be done clinically without destabilising the economy might be true. But there’s a risk that the Fed might consider in the other direction, of giving the incentive to cut as opposed to raise.”

The tariffs will also have a limited scope, Dani Rodrik suggests, and will not get Trump everything he wants, “which is to create good jobs, reinforce the middle class, make the country more secure right now, improve productivity and innovation and so forth.”

An economist and a Ford Foundation Professor of International Political Economy at the Harvard University’s John F. Kennedy School of Government, Rodrik says, “What tariffs is going to do, is raise the proper profitability of certain manufacturing companies in the United States and hurt the possibility of others… There’s no reason that because a corporation has become more profitable, that it’s going to invest in its workforce, that it’s going to invest in technological innovation.”

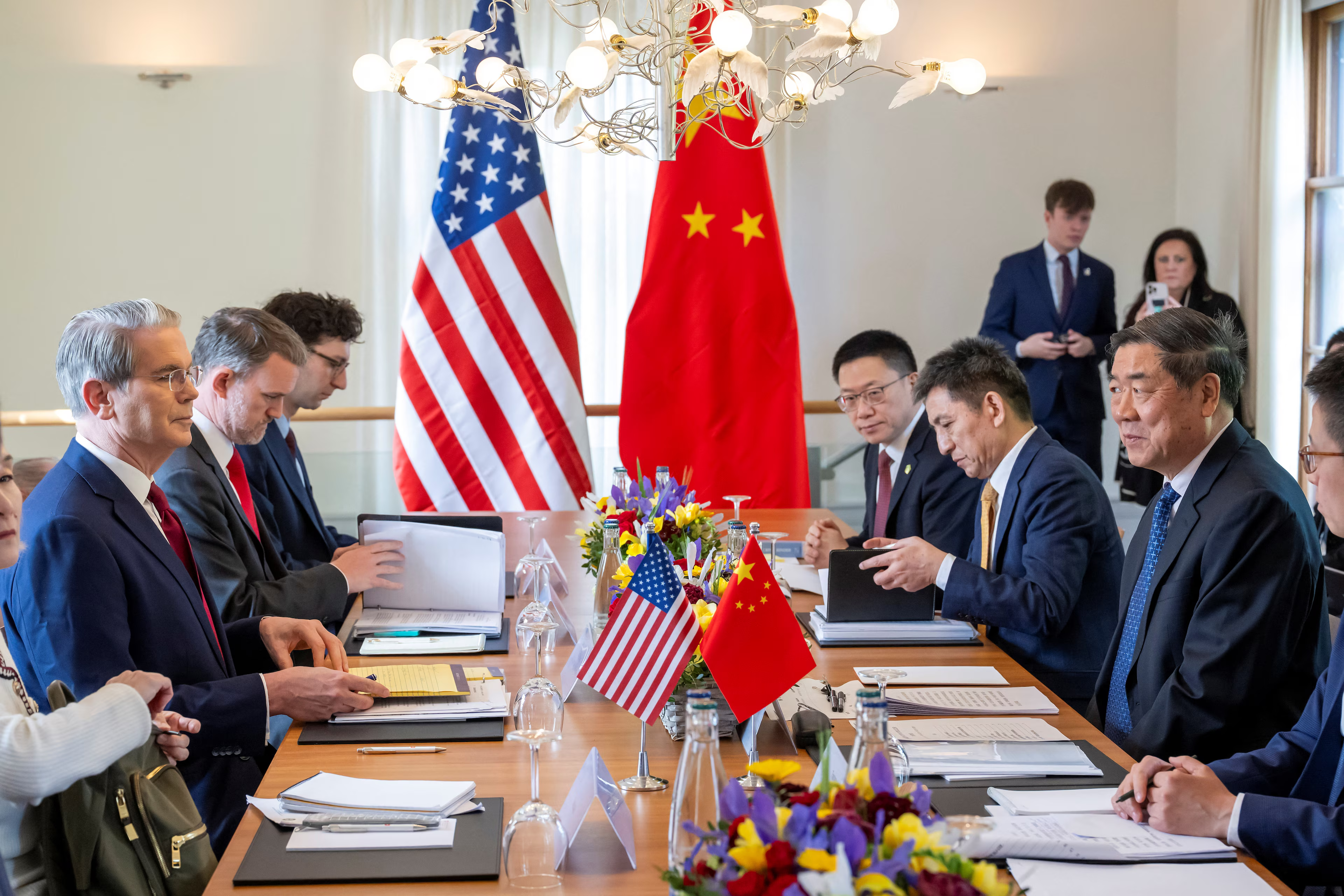

Beyond its borders, the reaction in China will be ‘somewhat muted’, according to Jin Keyu, Professor at the Hong Kong University of Science and Technology’s School of Business and Management.

“‘Trump 1.0” offered lessons, and “China understands much better now,” said Economist Zhu Min, also a former deputy managing director of the International Monetary Fund, referring to the country’s economic stimulus measures since September 2024 towards stabilising the market and boosting confidence, in “preparation for Trump’s comeback.”

Global trade growth will not take a big hit, according to Takeshi Hashimoto, President and Chief Executive Officer at Mitsui O.S.K. Lines. “Even during the previous Trump government, there was some tension between the US and China… [but] the total volume of the global trade did not decline.”

On Japan, Akazawa Ryosei, the country’s Minister in Charge of Economic Revitalization, believes they must “be prepared” for the impact over the next few months while strengthening the US-Japan bilateral relationship.

On conflict and geopolitics

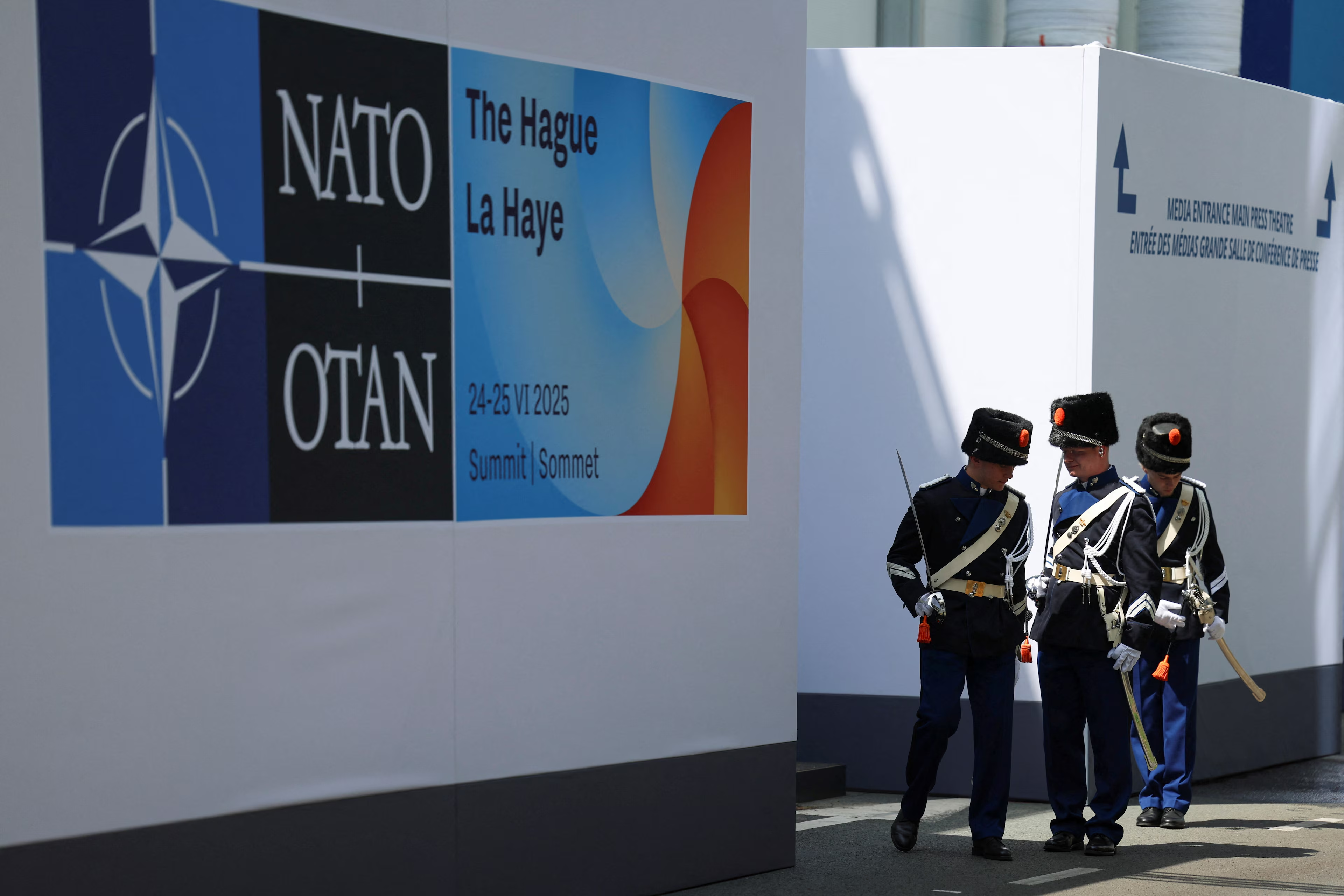

Olaf Scholz, the Federal Chancellor of Germany, stressed the importance of maintaining “a cool head”: “The United States are our closest ally outside of Europe, and I will do everything to ensure it remains like that, because it is in our mutual interest, because the close cooperation between Europe and the US is indispensable for peace and security around the globe, and because our partnership is also an engine for successful economic development.”

In another session, Belgium Prime Minister Alexander De Croo echoed similar views: “What we have to do, is be careful, to not be on a reactive mode everyday,” while clarifying there should be exceptions. “For example, if Türkiye, which is also a NATO ally, would talk about the Greek islands the way the United States have talk about Greenland, I think we would all be furious. So on certain occasions we have to be clear and say – ‘Look, this is unacceptable and this is a red line.’”

In this special address, Ukraine’s president, Volodymyr Zelenskyy, emphasized an active position: “Will President Trump even notice Europe? Does he see NATO as necessary? And will he respect EU institutions?”

“Europe can’t afford to be second or third in line for its allies,” he said. “If that happens, the world will start moving forward without Europe… Europe needs to compete for the top spot in priorities, alliances and technological development.”

Speaking on Europe’s potential, European Central Bank President Christine Lagarde echoed similar views: “We have to act together. And we have to play not just defence, but be forward.”

“The era of sovereignty is back,” says Dr. Comfort Ero, President and CEO of the International Crisis Group (ICG). “We are all going to be thinking from our own national interest for narrow national interest… a Trumpian kind of figure also needs to recognise that there are agents on the other side, who have also a very clear sense of their national interest.”

Finland’s President Alexander Stubb believes Trump is in favour of peace and “rightly” takes credit for bringing the ceasefire in Gaza.

UN Secretary-General António Guterres, during a question-and-answer session, similarly credited Trump’s efforts. “The negotiations were dragging, dragging, dragging. And then, all of a sudden, it happened,” Guterres said while also praising efforts by Qatar and Turkey.

“I think there was a large contribution of robust diplomacy of — at the time — the president-elect of the United States.”

Trump’s biggest priority in the Middle East now, according to Meghan O’Sullivan, the Director at Harvard University’s Belfer Center for Science and International Affairs, would be the normalisation between Saudi Arabia and Israel.

“This he sees as unfinished business from his first administration when you had the Abraham Accords,” she says, referring to his foreign policy achievement involving a series of normalization deals signed in 2020 by Israel and Bahrain, Morocco, and the United Arab Emirates. “It will be extremely hard to have that normalisation without a better outcome in Gaza. And that’s going to be another reason why there will be focus on Gaza by the Trump administration.”

And there’s Iran, “where the ambition would be much larger” for a deal that spans the country’s behaviour in the region.

She also remains optimistic about improvements in the US-China relationship where President Trump could take his “personal relationship with Xi Jinping and try to change it into something different.”

What could all this mean for the war in Ukraine? “The situation on the ground is actually much better than we think. It’s a war of attrition,” says Finland’s president while outlining the key principles of independence, sovereignty and territorial integrity will be crucial to a ceasefire deal.

“It’s a complex package. I don’t envy the Trump administration if and when they want to do a deal within 3 to 6 months, but I’m actually quite hopeful, because Trump needs to come out of this one a winner. And I think he will.”

Yuliia Svyrydenko, the First Deputy Prime Minister and Minister of the Economy of Ukraine, emphasizes peace on understandable terms as a key goal for the country, echoing the President’s views on security guarantees that would prevent a new Russian attack after any deal.

State-based armed conflict is the top risk for the year ahead. Find out more in the Global Risk Report 2025.

On climate goals

European leaders, who spoke on the EU’s climate ambition in a more competitive world after President Trump’s executive order to withdraw the US from the Paris Climate Agreement, reinforced the need to maintain focus.

“What we have in the Green Deal… we should stick to it from a climate perspective, but also from a competitiveness perspective,” said Alexander De Croo, the Prime Minister of Belgium, while addressing the President’s inauguration on Monday. “The world is full of uncertainty, [and] after yesterday, even more. And maybe tomorrow, there might be even more uncertainty.

“Let’s please, as Europeans within the European Union, not add uncertainty by creating ambiguity on our goals.”

Marc Ferracci, the Minister of Industry and Energy in France, said: “If there is a way for European countries to face, what I would say, is the ‘Trump challenge’, it’s unity.”

“We need to be firm and strong and alleviate the path and how we try to achieve the climate goals.”

The European Green Deal remains the central policy blueprint for achieving climate neutrality by 2050. How can the private sector leadership contribute while helping strengthen the continent’s position in the global economy? Find out more in the report ‘Delivering on the European Green Deal: A Private Sector Perspective – Second Edition’.

On immigration and labour

As President Trump began his efforts to secure the nation’s borders against migrants and enforce stricter measures on undocumented immigrants currently residing in the country through a series of executive orders following his inauguration, Miguel Medina, Honduras’s Minister of Investment said: “It’s something that will immediately affect more of the US economy,” referring to the role of immigration in filling the labour gaps.

There are going to be more winners and losers, he says. “Our region is going to be one of the winners. Once you put tariffs on Mexico, all these companies are going to look for the next best option to manufacture their products. And we’re right there…[but] it’s going to create a huge problem in Mexico because it will create massive unemployment.”

Amy Pope, the Director-General of the International Organization for Migration (IOM), highlighted the broader trend at play around the globe:

“We have lived in a system where we have failed to completely understand the market forces driving migration and the pressures driving people to leave. And the primary response of many governments is to do more on border enforcement rather than identifying what’s driving people to leave.”

On supply chains

When Pan Jian, representing the world’s largest electric vehicle (EV) battery maker as Co-Chairman of CATL, was asked about the advice he would give Donald Trump on EVs, he said: “It’s not going to be a one-country effort in terms of EV.”

“It’s going to be a global effort, and people have the impression that China is dominating the whole supply chain. But it’s not true because it overlooks one important aspect of the story: the production capacity in China is very high today along the supply chain but if you look at the end market, it’s also Chinese, accounting for 70% of the overall market.“

“So with the spread of EVs in different markets in the world, we believe the supply chain production also spreads around in different parts of the world.”

Industry leaders on the future of EV supply chains amid US-China tensions

On crypto and digital assets

The comeback of a Trump-led US administration has sparked optimism among cryptocurrency firms, including Coinbase.

CEO Brian Armstrong says the payment growth, the ETFs, the adoption by Fortune 500 companies’ indicates a Trump effect. “To have the leader of the largest GDP country in the world come out undeniably and say that he wants to be the first crypto president, he wants the industry to be built in America… that he’s going to direct every agency of the US government to work towards clear rules which enable innovation. This is unprecedented.”

The importance [of the crypto industry] is now clear, says Denelle Dixon, the CEO and Executive Director of Stellar Development Foundation. “We need to be able to create strong regulation that makes sense for the industry and for innovation.” Panelists in a session tackling the outlook of these digital assets, including SkyBridge Capital’s Founder Anthony Scaramucci, largely believe will be more regulatory clarity with bipartisan commitment and “no anti-crypto voters.”

Presenting a counter view, however, Lesetja Kganyago, the Governor of the South African Reserve Bank (SARB), says: “I don’t think it is for government or for regulators to tell financial consumers which products should and should not be used. Our duty as regulators is to make sure that the products that exist are transparent and fair to consumers.”

Can crypto quickly become a way of payment in the US? “Crypto and where it becomes a means of payment is typically in countries where you don’t trust the currency,” remarks Raghuram G. Rajan, the Former Governor of the Reserve Bank of India and now the Katherine Dusak Miller Distinguished Service Professor of Finance at the University of Chicago’s Booth School of Business.

“If you contrast India with the US, one of the big expansions in payment in India is direct bank-to-bank payments or UPI [with] 12 billion transactions last month, not via card but direct payments. The Fed just started in 2024 – FedNow… that would be a substitute for credit cards if that happens. But it hasn’t caught on as yet, unlike UPI.”

The slew of executive orders issued on Monday show “there’s going to be a lot of changes that we all have to digest,” according to Mary Callahan Erdoes, the CEO of J.P. Morgan Asset and Wealth Management at JPMorgan Chase. “But a lot of this is exactly what you would do to have a very pro-business environment.”

In particular, she pointed to President Trump’s executive order ending remote work for federal employees: “You just say to yourself – ‘thank God the US government has done it.’ And hopefully, that’ll keep us ahead of other governments in the world so we can continue to compete.”

As states increasingly use the global financial system to advance geopolitical objectives, there is a risk of financial system fragmentation. But at what cost? Find out more in the report Navigating Global Financial System Fragmentation.